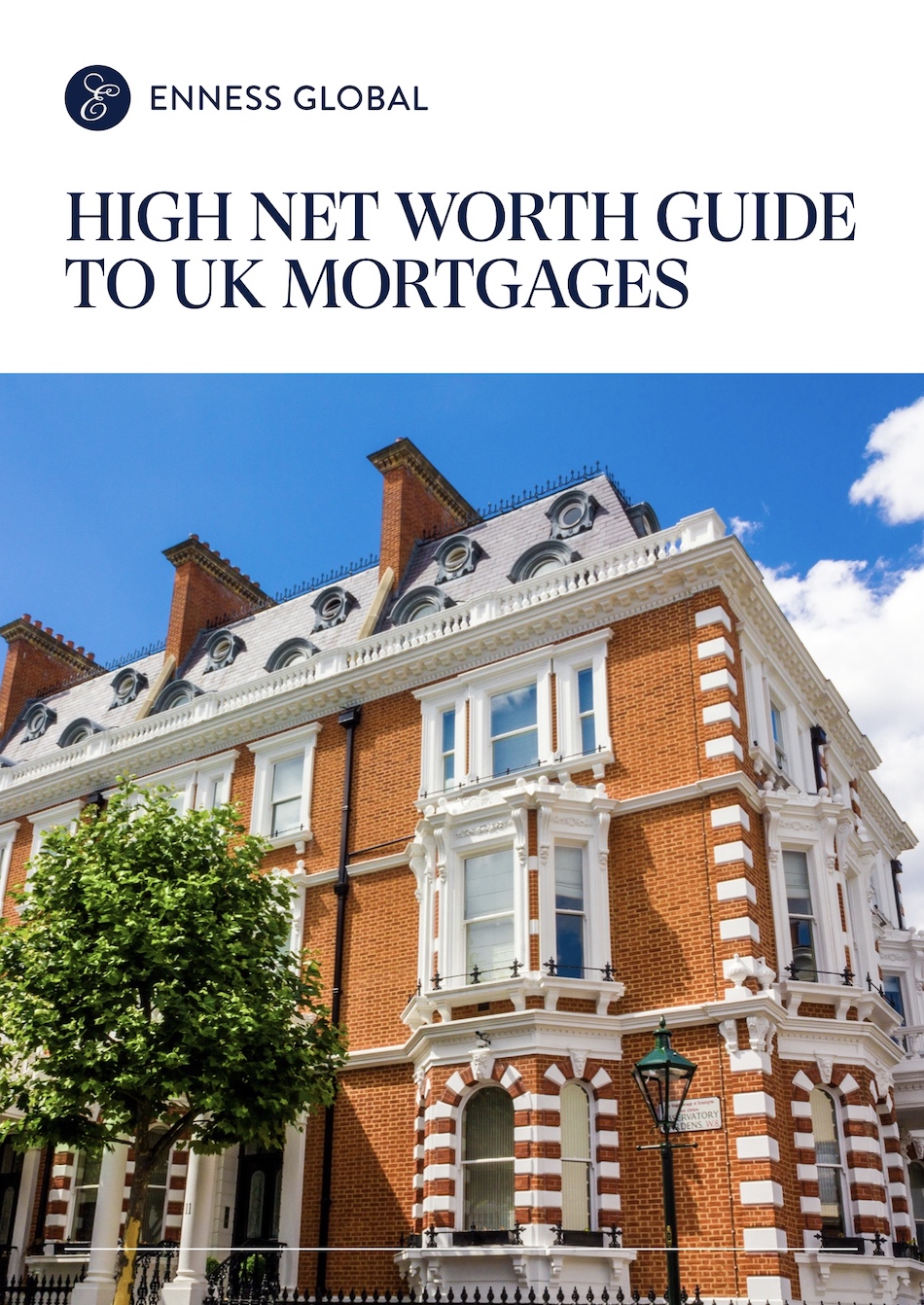

The worldwide mortgage market covers various scenarios and different clientele who all have diverse financial situations.

"Off-the-shelf" mass market mortgage products offer enough variation for "traditional" mortgage applicants. However, such products are unlikely to be enough if you are a high-net-worth individual looking for a large mortgage.

You may have a complex financial situation and are likely to require a bespoke mortgage arrangement. High-net-worth mortgages not only need to suit you as a borrower, but they also need to provide lenders with enough peace of mind to give the green light on your loan in the first place. High-net-worth mortgages need to work for all parties involved, and there is often a greater need for flexibility, visibility and access to significant finance than in any other area of the mortgage market.

According to the UK’s Financial Conduct Authority, the criteria for a high-net-worth mortgage is either if you are an individual who has a personal income of more than £300,000 or if you have liquid assets of more than £3,000,000.

If you meet these criteria, lenders may loosen some rules (for example, on affordability). As a result, you may be able to benefit from a more tailored and personalised mortgage product.

Typically, these solutions are offered predominantly by private banks or specialist departments of global lenders.