THE SCENARIO

As an associate in Enness’ Dubai team, my role is to refer clients to the London office where the team will work to secure their property investment desires both in the UK and abroad.

Recently, I referred an Irish client to the London office who was looking to expand his property portfolio in London and Ericeira, Portugal. His home was in Dubai, but he received multiple incomes in several currencies – Pound Sterling, UAE Dirhams and Euros. He owns rental properties in London, a tax company in Dubai and a distillery company in his native Ireland.

With regard to his London properties, the client was looking to refinance three plots from his portfolio and release equity for future purchases. The total value of the three properties was £1.625million, for which he was originally looking to remortgage in one single transaction.

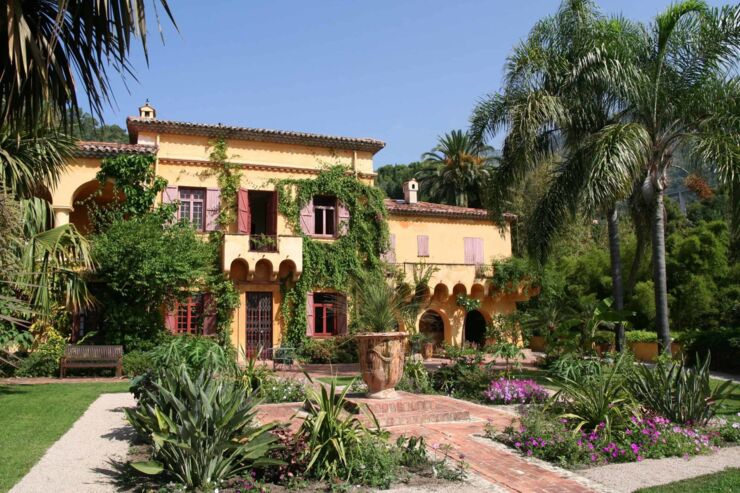

At the same time, he was looking at buying a beautiful property valued at €500,000 in Ericeira, a popular surfing spot. He intended to use this as both a holiday home and to generate rental income.

The client was hoping for a high loan to value (LTV) on all properties in both countries. However, it is extremely challenging to secure a rate higher than 50% for Dubai-based clients wishing to purchase in Europe. In addition to his complicated income structure, his accounts were audited by a Dubai-based firm, presenting us with several difficulties to resolve.

OUR SOLUTION

Finding solutions for foreign national’s mortgage complications is a speciality of ours. To simplify the remortgage process for the three London properties, it became clear that we had to break the single case down into three separate applications in order to maximise the potential LTV.

Following some careful research, the London team approached an international lender who was able to consider the three properties separately. This meant that they were able to offer a very attractive 75% LTV on each property at a rate of 3.34% fixed over a 2-year term on an interest-only basis.

During the process of the London property transactions, it was found that a Europe-based bank was comfortable with considering the client’s needs for the Portugal property. The team in London negotiated an exceptional offer of 70% LTV with the option of either a 5-year fixed-rate at 1.65% or a 1.25% plus 12-month Euribor (Euro Interbank Offered Rate) variable.

Not only is it very unusual for these high LTVs to be offered to clients based in Dubai – since banks will only typically offer UAE clients an LTV up to 50% – but also for the client to be given two options is very appealing. He was incredibly pleased with this deal, and I was hugely satisfied to have referred to another happy client.

Our rate of returning clients at Enness is something that I am very proud of. It is with great pleasure that we offer individuals multiple services tailored to their individual needs and we make sure to assist in every step of the complicated mortgage process.

Information contained in our case studies is for market and illustrative purposes only. In some cases, these may be made up of multiple cases and are for illustrative purposes only.

Some case studies are made up of enquiries that have come into the business, not all business completes, and the posting of a case study does not represent a completed piece of business.