LAST UPDATED: 17/01/2025

What is Bridging Finance and How Does it Work?

A bridging loan, as the name suggests, is used to ‘bridge a financial gap’ over the short term. This can be anything from 24 hours to three years and is usually related to commercial and private property. For example, an individual purchasing at auction is required to pay immediately but may not have funds available from their current property. This is where short-term access to external finance can come into its own, particularly when dealing with sums requiring a more bespoke approach, such as over £5m.

Video Insight: Large Bridging Loans Explained

Understand the nuances of high-value bridging finance, including use cases and practical scenarios.

Up until the sub-prime financial crisis of 2007/8, the market was largely dominated by high-street banks, but the picture over the past decade has changed markedly. In part, this is because everyday institutions have taken a more risk-averse approach to financial products, which bridging loans are deemed to fall under. They also weren’t best placed or agile enough to deal with the requirements and capital involved with high-end, luxury property sales, especially in a post-bailout world. This, though, was not the end of the story. As with most things in the financial world, when a gap in the market forms, it’s quickly filled through alternative methods.

Get in the Know

Subscribe to our newsletter

Types of Bridging Loan Arrangements

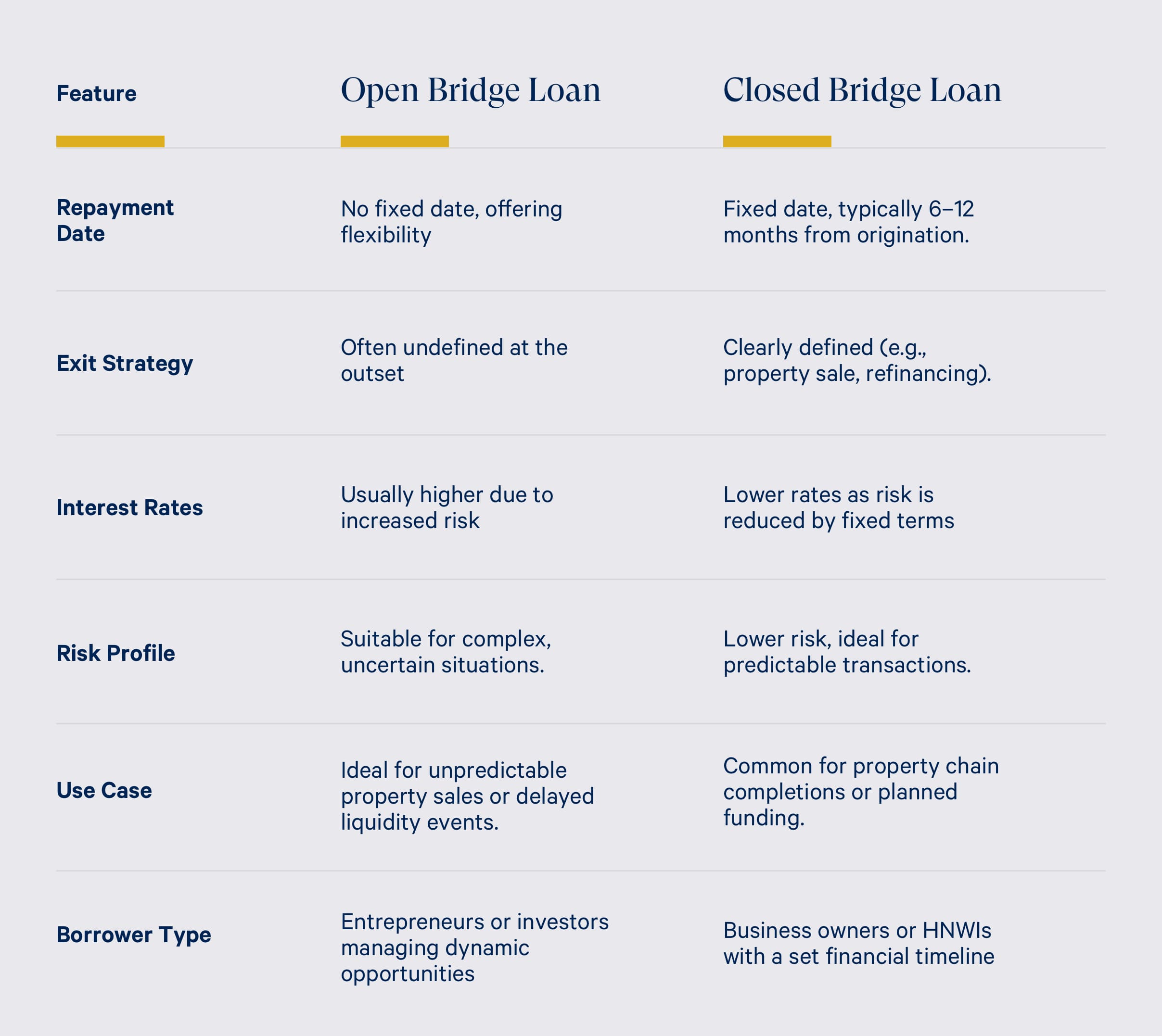

There are generally two types of bridging loans:

-

Closed Bridging Loan: This loan type is used when there is a defined repayment date, such as when the borrower has a guaranteed sale or funding lined up. It is often easier to secure as the repayment is considered more certain.

-

Open Bridging Loan: This type is used when the borrower does not yet have a set repayment date. It is more flexible but generally carries higher interest rates due to the increased risk for the lender.

Key Features of Bridging Loans

Bridging loans are highly versatile financial tools, designed to meet the immediate liquidity needs of high-value transactions. Here are some of their defining characteristics:

- Interest Rates: Bridging loan rates typically range from 0.4% to 1.5% per month, depending on factors such as the loan-to-value ratio, asset quality, and the borrower’s profile. Competitive rates are usually available for lower LTV transactions.

- Speed: Bridging loans can often be arranged within 24 to 72 hours for straightforward deals. More complex transactions may take 1 to 2 weeks, depending on due diligence and valuation requirements.

- Collateral: These loans are secured against property or other valuable assets, such as residential, commercial, or mixed-use real estate. Lenders usually cap the LTV ratio at 70% to 80% of the asset’s value.

- Flexibility: Bridging loans can offer repayment flexibility, particularly when dealing with open arrangements. However, borrowers should note that some agreements include minimum interest periods, which may impact early repayment strategies.

Download Our Bridging Finance Guide

Gain valuable insights into bridging finance, from interest rates to application timelines. Whether you're securing a luxury property or managing a complex transaction, this guide covers all the essentials with clarity and precision.

Case Study: Fast Bridge Loan for West African UBO Using an East Asian SPV

A dual-national client residing in West Africa sought £5M+ in bridging finance to purchase and modernise a £4M London property. They planned to release equity from their £4M portfolio to fund the deposit.

The client’s ties to a high-risk jurisdiction and the uninhabitable state of their properties made the deal complex. Enness negotiated a 70% LTV bridge loan with a privately funded lender, who required a legal opinion due to the East Asian SPV structure. Thanks to the lender’s flexibility and the client’s clear exit strategy, the loan is set to complete within 4–6 weeks, meeting their deadline.

The Post-Pandemic Lending Landscape

While the global Covid-19 pandemic has impacted many areas of finance, bridging loans have proven resilient in a rapidly changing financial environment. Specialist bridging lenders were not hindered by the same red tape and bureaucracy as traditional banks, allowing them to assess situations on a case-by-case basis and respond faster.

Bridging finance providers have adapted to the post-pandemic world, leveraging technology and close relationships with surveyors to facilitate quicker and more accurate valuations, even in uncertain times.

How Bridging Finance Helps

For example, a client purchasing a luxury London apartment at auction required immediate capital but was awaiting the sale of their existing property. A bridging loan enabled them to secure the property without delay. They repaid the loan once their previous property sold, demonstrating how bridging finance can offer the liquidity needed to act swiftly in high-stakes property transactions.

Case Study: Competitive Bridge Loan for UK Property Purchase

Enness recently assisted a dual Nigerian and UK national who needed £630,000 to part-fund the purchase of a £1 million UK property. The client, a Lagos-based oil and gas professional, owned a London property outright via a Hong Kong SPV but faced challenges due to their international profile and the SPV structure.

Most lenders deemed the client high-risk, requiring a custom solution. Enness leveraged its expertise to secure a 10-month bridge loan at a competitive rate of 0.89% per month, with no penalties for early repayment. We worked with a lender who allowed the entire process to be completed remotely, eliminating the need for the client to travel to the UK to sign loan documents.

How can Enness help?

At Enness, our independent status allows us to engage with the entire market of bridging finance providers. We don’t have any restrictions, which has enabled us to build strong, trustworthy relationships with a wide variety of lenders. This means we can match you with the right provider and structure a solution that aligns with your needs and plans, without relying on a scatter-gun approach.

Whether you’re looking to secure funding for a high-value transaction, improve your rates, or explore more flexible financing options, we can help.

One client shared their experience:

"Was a rather complicated Bridge because lenders solicitor was difficult and picky. But Fergus got me there in the end. Delighted. He worked hard to get me past the finish line. Thank you. - Francesca de Bryas"

We offer a range of bridging finance products to meet various requirements, including:

- International Bridging Loans: For cross-border property purchases or transactions requiring financing across multiple jurisdictions.

- Auction Bridging Finance: Fast access to funds to secure property acquisitions at auction.

- Property Development Bridging Finance: Short-term funding for starting or completing residential or commercial development projects.

- Bridging Loans for Land: Financing for land purchases, whether with or without planning permission.

- Residential Bridge Loan: Designed for high-value residential property purchases, refinancing, or bridging the gap between transactions.

- Business Bridging Loan: A flexible option for businesses requiring immediate liquidity for operational expenses, acquisitions, or other financial needs.

If you’re unsure whether bridging finance is the right solution for your situation, or if you’re looking to improve your current terms, our experienced brokers are here to guide you. Contact us for a no-obligation discussion about how we can help you achieve your goals.

Bridging Finance FAQs

1. What is the typical interest rate for a bridging loan?

Interest rates for bridging loans vary depending on the lender, the loan-to-value ratio, and the complexity of the deal. Generally, rates range from 0.4% to 1.5% per month, equating to annualised rates of 5% to 18%. High-value transactions with lower LTV ratios and strong exit strategies often secure more competitive rates.

2. How quickly can I get a bridging loan?

Bridging loans are designed for speed. In straightforward cases, funds can be arranged and disbursed in as little as 24 to 72 hours, particularly with experienced brokers and agile lenders. For more complex transactions, the process typically takes 1 to 2 weeks, depending on due diligence and valuation requirements.

3. What collateral is required?

Bridging loans are secured against assets, most commonly real estate, including residential, commercial, or mixed-use properties. For high-value transactions, lenders may accept additional forms of security, such as multiple properties or other valuable assets. The loan-to-value ratio is usually capped at 70% to 80% of the property’s value.

4. Are there penalties for early repayment?

Most bridging loans offer flexible repayment terms, and many lenders do not impose penalties for early repayment. However, some agreements may include minimum interest periods (e.g., 3 months), meaning you could still be required to pay interest for that period even if you repay early.

5. How long do you have to pay back a bridging loan?

Bridging loans are typically repaid within 6 to 12 months, though terms can range from a few months to three years. The repayment period depends on the loan type and the borrower’s exit strategy, with most loans being repaid through property sales or securing long-term funding.

6. Can You Have Two Bridging Loans?

It is entirely feasible to secure two bridging loans at the same time, provided that you satisfy the lender’s requirements and present a clear repayment strategy for both facilities. This approach, often termed "multiple bridging loans," is a common solution for HNWIs or seasoned investors managing intricate financial transactions.