France – arguably – has some of the most luxurious, desirable and beautiful prime real estate in Europe. As a result, many wealthy Middle Eastern families purchase French property. However, for Qatari nationals, there are unique and highly advantageous fiscal benefits that mean buying prime property in France is particularly appealing from a financial perspective.

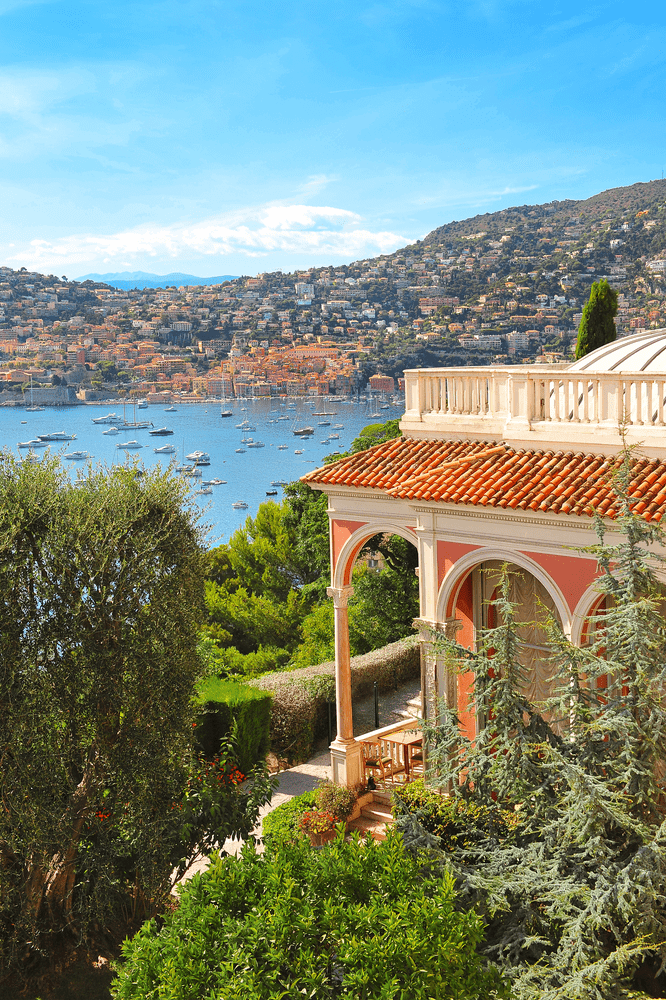

There is no restriction on ownership of French property, and many Qatari nationals purchase Parisian mansions and apartments, chalets in the Alpes and villas on the Cote d’Azur. Some of these are trophy homes, while others are buy-to-let investments, holiday homes or simply investment property that they will hold as an appreciating asset. While residential property purchases tend to be the norm, many Qataris, including the Royal family, own prime commercial real estate, including some of the most recognised buildings in Paris, including several on the Champs-Elysees.

Favourable Tax Regime Exclusively For Qatari Nationals Owning French Property

France and the State of Qatar have a unique fiscal regime that allows Qatari nationals that invest in France to benefit from a highly favourable tax situation. The treaty between the two governments was initially introduced under President Sarkozy in 2008 to strengthen economic and business ties between France and the State of Qatar, and to encourage more French investment from Qatari nationals.

At a basic level, Qatari nationals are exempt from paying withholding tax on capital gains realised through French real estate ownership. The regime is applicable when dividends are paid to a Qatari resident via a French corporate entity. Usually, foreign investors pay dividends on French real estate (typically applicable when the property is sold) and this is taxed at France’s standard rate. However, if structured properly, under the treaty Qatari nationals do not incur any financial liability in this respect. It is worth noting that this is a special agreement signed between France and Qatar – this provision is not found in any other convention signed by France with regard to real estate capital gains exemption.

The same is also applicable to French residents who would be eligible to pay withholding tax on dividends disbursed via a Qatari entity. However, this isn’t as common: the regime was predominantly enforced with the aim of benefitting the Qatari nationals that pay would otherwise pay dividends in France on real estate and other assets.

Get in the Know

Subscribe to our newsletter

Why Buy Property In France?

- No withholding tax is applicable on capital gains realised through real estate ownership when appropriately structured

- Strong, liquid and enduring prime property market that continues to appreciate upward in the long-term

- Plentiful prime residential real estate on offer across France including trophy homes, historical properties, mansions, apartments, modern and classical villas and chalets. France has a strong ultra-prime property market with plenty of properties available for €10 million or more. Unique and one-of-a-kind residences are available, including new builds

- As a country, France is large enough to offer a variety of different regions that offer property owners different experiences: some of the most beautiful cities in the world (shopping, arts and culture) and some of the best coastal living in Europe (sea, beaches, warm climate, year-round sun) and mountains (skiing, mountain sports, activity holidays)

French Mortgages And Property Finance – What To Know

Enness arranges high-value mortgages for Qatari clients purchasing prime and ultra-prime French property in Paris, on the French Riviera and in the French Alps. Even for the very wealthy, purchasing French real estate with a mortgage is usually fiscally advantageous, and in many cases, we can arrange finance to deliver a 100% loan-to-value mortgage from a private bank if certain conditions are met.

Mortgages can also be more advantageous when it comes to financial planning. France’s wealth tax is usually due against any assets held in France – so the total price of a property, if just purchased in cash. If you have a mortgage on that property, wealth tax is only levied against your equity in the property, which usually represents a significant saving over several years. A French mortgage for prime property will also usually save borrowers significant bank and exchange rate fees. Today, lenders offer a variety of mortgages for non-resident investors, including interest-only mortgages. Very high-value mortgages (€15 million +) are available.

How Qatari’s Can Finance French Property

While the French government has actively looked to encourage Qatari investment into the country, getting a high-value mortgage can be complex for Qatari nationals working without specialist advisors to broker the deal.

For many wealthy Qataris allowances, gifts, donations, wealth planning and estate planning structures are all relatively commonplace, but many French retail banks will struggle to lend in deals where these elements are present. France’s mainstream retail banks will also struggle to offer the amount of finance that Qatari’s typically need for prime property purchases. It is almost always more efficient to work with international private banks to secure a high-value French mortgage – and rates and terms will also be more advantageous and these are usually additional benefits, such as funds under management being actively managed to pay off the interest associated with the mortgage, and so on. Private banks are also able to understand Qatari borrowers’ financial backgrounds, which can be different to those seen in Europe where income tends to be structured in relatively standard ways. Private bank mortgages brokered by an expert, on the other hand, will usually deliver a multitude of benefits.

Enness will arrange finance through private banks using the structures that will allow Qatari nationals to benefit from the special treaty between France and the State of Qatar. To do this, we will work with our client’s advisors to structure the finance and to ensure the package is optimised as much as possible. We also work with Qatari nationals that don’t have an existing credit footprint in Europe, arranging mortgages through lenders in our network. This will essentially provide Qatari nationals with a French credit footprint which can facilitate access to finance, loans or banking relationships in Europe.

How Can Enness Help?

Enness is a high-value mortgage broker. We work with wealthy individuals and families from around the work to access mortgages, bridging loans and other types of property finance. We specialise in negotiating large European mortgages of several million pounds, including in multi-million-euro property deals. Used to working with highly ambitious clients and in confidential deals, our brokers have worked with globally-recognised ultra-high-net-worth individuals, royal families, and celebrities.

Enness:

- Arranges French mortgages – including very high-value mortgages – for Qatari borrowers easily and quickly

- Can negotiate mortgages for individuals or families with complex, unusual or delicate financial backgrounds

- Works on a case-by-case basis, structuring every deal specifically to meet the exact requirements of the borrower

- Will always look to maximise LTV and minimising the asset, and keep overhead costs as low as possible

- Will advise on the best finance package available. We are experts in arranging competitive interest-only and 100% LTV mortgages available from private banks when assets are placed under management

- Have excellent relationships with private banks and niche lenders with links to Qatar and the Middle East to facilitate lending

- Can arrange finance for individuals even if they haven’t got any European credit footprint

- Also arranges bridging loans and equity release secured against prime French property

This guide is for information and illustrative purposes only and nothing contain within should be construed as advice, a recommendation or professional advice.

Financing options available to you will depend on your requirements and circumstances at the time. Any changes in your circumstances, any known likely changes, or omissions in the information you provide can affect the suitability of the options available to you. These should be communicated to us as early as possible.

If you are considering securing debts against your main home, such as for debt consolidation purposes, please think carefully about this and consider all other options available to you.

Your home may be repossessed if you do not keep us repayments on your mortgage or other debts secured on it.